Solutions for the QuickBooks balance sheet Out of balance issue:

QuickBooks stands as a global leader in accounting software, celebrated for revolutionizing financial management across large corporations, medium and small businesses, and even for individual use. Its robust features significantly simplify complex financial operations.

While QuickBooks Desktop is an incredibly powerful tool, like all software, it can occasionally encounter errors. The good news is that most QuickBooks issues are easily fixable!

This comprehensive resource is designed to empower you with the knowledge to resolve QuickBooks Desktop errors efficiently. Whether you prefer self-help solutions through detailed articles or require expert assistance, we’ve got you covered. Dive in to troubleshoot common QuickBooks problems and keep your financial operations running smoothly.

Steps to Fix QuickBooks Balance Sheet Out of Balance Issue

Below are the different solutions you can try to fix QuickBooks balance sheet out of balance on an accrual basis.

- Troubleshoot basic data damage

- Resolve manually the transactions responsible for the balance sheet that is out of balance.

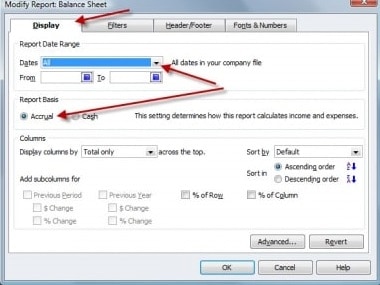

Step 1. Switch the Report to an Accrual Basis

Checking whether the balance sheet is out of balance in both accrual and cash basis will help determine how to troubleshoot this issue.

- From the ‘Reports menu‘, you need to choose the ‘Company & Financial‘ option.

- And then choose ‘Balance Sheet Summary‘.

- After that choose the ‘Customize Report‘.

- Next, select the ‘Accrual under Report Basis ‘on the Display tab, .

- Finally hit a click on “OK” button.

If the report is out of balance in both accrual and cash basis, your file might be broken. Refer to resolve a balance sheet out of balance in accrual basis for troubleshooting steps.

In the event the report is in equilibrium in accrual although not in cash, it means there are some problems with specific transactions.

Step 2. Understand Why QuickBooks Balance Sheet Went out of Balance

- First thing to do is go to the ‘Reports menu‘ option

- Then you have to select ‘Company & Financial‘

- You will get ‘Balance Sheet Summary‘

- Now choose the ‘Customize Report‘

- After this go to the ‘Display Tab‘

- Set the ‘Report Basis‘ to cash

- Once done you can modify the columns as per the year/month/week/ day the balance sheet went out of balance.

If it is the year:

- First you have to Select All from the ‘Dates drop-down‘

- Now choose the ‘Year‘ from the Display columns

- After this tap on ‘OK‘ button.

- Compare the ‘Total Assets‘ and ‘Total Liabilities‘ in order to find out the year the balance sheet went out of balance.

If it is month:

- You will come across the ‘From‘ and To ‘Fields section‘ where you have to enter the year balance sheet went out of balance.

- Now select ‘Month‘ from the ‘Display columns‘.

- Tap on ‘OK‘ button.

- In last compare the ‘Total Assets‘ and ‘Total Liabilities‘ in order find the month the balance sheet goes out of order.

If it is week:

- In the ‘From and To’ fields, enter the month your balance sheet goes out of balance.

- From the Display columns, select the ‘Week‘

- Choose ‘OK‘ button.

- To find the week the balance sheet goes out of balance, compare the ‘Total Assets‘ and ‘Total Liabilities‘.

If it is the day:

- In the From and To Fields, enter the week your balance sheet goes out of balance.

- Choose the day, from the ‘Display columns‘,

- Next, hit a click on ‘OK‘ button

- To find the day the ‘Balance sheet‘ goes out of balance, compare the ‘Total Assets‘ and ‘Total Liabilities‘.

Step 3. Track the Transaction Responsible for QuickBooks Balance Sheet out of Balance

After you find out the date when the Balance sheet goes out of balance, make a Custom Transaction Detail Report in order to track the transaction which might be causing the issue.

- Move to the ‘Reports menu‘ then choose ‘Custom Transaction Detail Report‘

- In case the ‘Modify Report‘ does not open automatically then select the ‘Customize Report‘.

- Now, hit on the ‘Display tab‘ and type the date where balance sheet was out of balance in the form of boxes From ‘Report Date Range‘.

- After this, set the ‘Report Basis to Accrual‘.

- Under columns you have to ‘Uncheck account‘, split, ‘CLR‘ as well as class.

- You can now ‘Check the amount‘

- Tap on the ‘OK‘ button

- Now the amount which went out of balance will appear as the ending balance in the report.

![How to Resolve Balance Sheet Out of Balance in QuickBooks Desktop? [Step 2] Track the transaction responsible for QuickBooks Balance sheet out of balance - Screenshot](https://axpertadvisors.com/wp-content/uploads/2019/05/Step-2-Track-the-transaction-responsible-for-QuickBooks-Balance-sheet-out-of-balance-Screenshot.jpg)

In case you are not able to track down the transaction that is causing the problem then run the below mentioned reports:

- Customer Report

- Journal Report

- Vendor Report

- Other Transaction

Step 4. Re-Date the Transactions

- Once you are identified the transaction or transactions that are causing the problem. It is supposed to ‘change the dates‘ on them. Also, note down the current dates, followed by editing the date on each of the transaction to a day 20 years in the future.

- After that, you need to ‘save each of the transactions‘.

- And then, refresh the report, if the users finds correct transactions, then the paid amount column will get ‘Zero‘.

- Now ‘locate the transactions‘ that you have dated into the future and then date them back to their original date. The point to be noted here is that the re-dating step basically re-links the transactions and can simply repair them.

Step 5. Removing and Re-Entering the Transactions

In case you are unable to fix the issue even after changing the dates, then in that case it is recommended to delete and re-enter the transaction once.

Check and Fix Specific Data Damage

This specific data damage may consist of the journal entries showing amounts without the associated accounts, the balance sheet summary out of balance, discrepancy in the column settings, and differences in the cash and accrual balance sheets. It is manual troubleshooting that can actually resolve the issue.

QuickBooks Balance Sheet Out of Balance and Its Causes

You might see the following error message on the desktop screen when the Issue of the Balance sheet Out of Balance in QuickBooks happens.

Accrual basis of accounting basically records expenses and revenues as they are earned even though there can be changes in cash. There can be various causes behind this error namely:

- Company data file gets damaged.

- Transactions entered or links have compatibility issues.

- If you are making use of multi-currency feature.

Important Points to Remember

- First of all you need to modify the reported total by year.

- And then check if the balance sheet is back in balance.

- Furthermore, log out of the QuickBooks file and log back in.

- Backup the QuickBooks company file before performing any steps for troubleshooting.

- If in case you are working in a multi-user environment, it might cause damage to the company file and balance sheet might go out of balance.

- Fixing the data damage and using the main system from where the file is hosted is recommended.

- Ascertain to verify and rebuild the QBWIN logs before proceeding.

Wrapping up!

We have a firm hope that you must have successfully resolved the QuickBooks balance sheet out of balance issue. If still the problem persists, then you can call our 24/7 QuickBooks error support team and seek assistance. The best part is that are certified experts are available 24/7 and provide instant solutions. Our dedicated helpline is available round the clock.

You may also like: