Are you working with multiple currencies in QuickBooks Online and are encountering the Multi currency Journal entry error? Pertinently, all the customer and vendor-related transactions should necessarily be recorded in the form of the currency that is being assigned to that particular vendor or customer. Users who face this error witness the following error message on their screen:

“Something is not quite right: You can only use home currency balance sheet accounts with home currency A/R and A/P accounts”.

Delve deeper into this blog to get a better insight into the different walkways to record the Multi-currency Journal Entries in QuickBooks Online without encountering the Journal Entry problem.

What does the Multi-currency Journal Entry Error in QuickBooks mean?

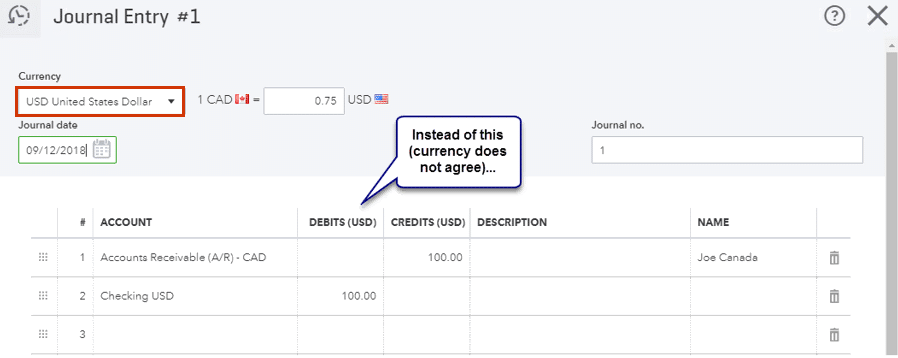

This error indicates that while proceeding with the creation of a journal entry which subsumes the Accounts Receivable (A/R) or the Accounts Payable (A/P), the user has made a mistake because of which the currency of the transactions, the A/R and A/P accounts, and the customers/vendors are mismatching.

Procedure to Record the Multi-Currency Journal Entries without facing Journal Entry Error

QuickBooks Online blacklists those journal entries that mix different currencies for customers because these may result in incorrect open balances or erroneous exchange profits or losses. Users can resort to the following methods to record such payments in QBO and avoid Journal entry errors:

Approach 1

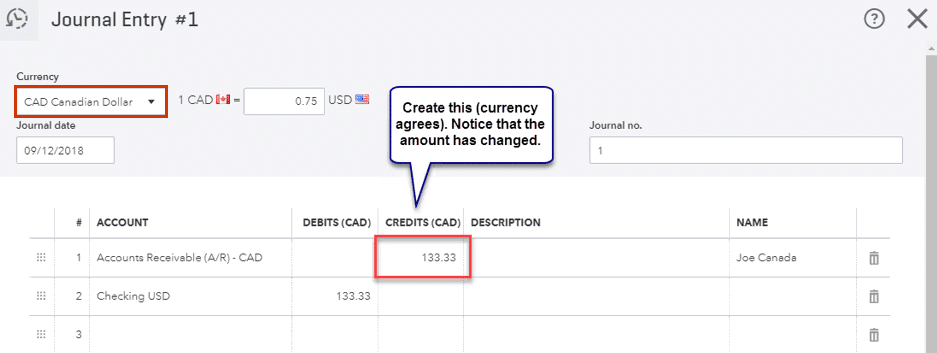

This method should be given precedence over rest of the methods. Users can recreate erroneous journal entry and make sure that transaction currency, A/R or A/P currencies, and customer are all matching. This might require manual conversion from one currency to another by taking help from the exchange rate from the deleted journal entry.

For example: If a journal entry was created for a foreign-currency customer or some vendor in the home currency, the user can go for the creation of a replacement journal entry in case of the foreign currency. This is possible by division of the home-currency amounts from the deleted journal entry.

It is highly recommended that users take a note of the actual currency in journal entry, in the Memo field

Approach 2

Step 1:

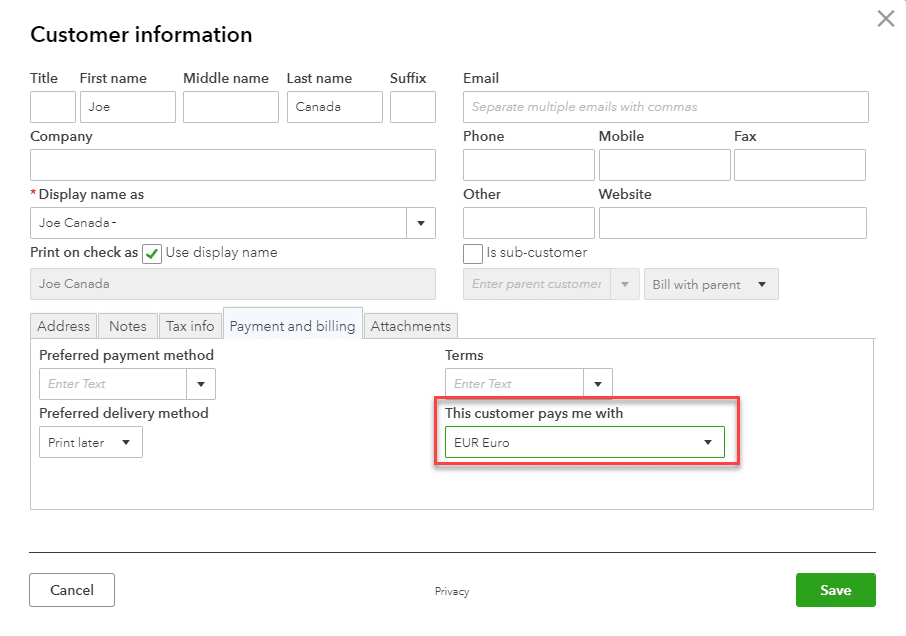

Go for the creation of a duplicate customer from the original journal entry. Subsequently, the second currency to be used can be assigned to this duplicate customer. The user is, however, required to adopt some distinct display name attributable to the duplicate customer/vendor.

For example, consider a scenario wherein the original customer/vendor had been assigned CAD. However, he/she wishes to process the payment in EUR. The solution in such a case is to go for the creation of a duplicate vendor/customer, and then assign EUR to it. Finally, incorporate space-hyphen following the Display name.

Step 2:

Invalidate any transactions that are open that pertain to the original customer or vendor in the first currency but is required to be in the second.

Step 3:

The user should recreate the multi currency journal entries that are erroneous by making use of the duplicate customer, such that they are associated with the right currency. The user can refer to the printout of the deleted journal entry to check for the exchange rate, home currency, and foreign currency amounts for the recreation of these transactions.

For Example: In case the user invoiced his/her customer in CAD, but the customer made payment in USD, then in that case, the user should:

- Make a duplicate customer and associate the USD currency with him/her.

- The user can receive the payment made by the customer in USD payment against the USD invoice.

- Confirm to voiding the CAD invoice to the vendor/customer.

- Go for recreation of the invoice by using the USD copy of the customer having the prices in USD.

Approach 3

For those users who have proficiency over accounting, they can employ a home-currency wash account and two journal entries for moving a payable or a receivable across two customers in different currencies.

Step 1:

Start off with the creation of an empty cash-on-hand bank account (in the home currency). This account will be employed only in case of currency transfers and it should in no case carry any balance. As a precedent, in case the home currency is USD, the user should necessarily go for the creation of the wash account in USD.

Step 2:

Proceed with the creation of the duplicate of the customer from the original journal entry. Subsequent step is to assign the second currency. The user is required to ensure that a different display name is allotted to the duplicate customer. For instance, if the CAD currency was associated with the original customer, but he/she wishes to make payment in some other currency like EUR, then the user should proceed with the creation of a duplicate customer. Follow up by assigning the EUR with this customer, and finally introduce space-hyphen following the Display name.

Step 3:

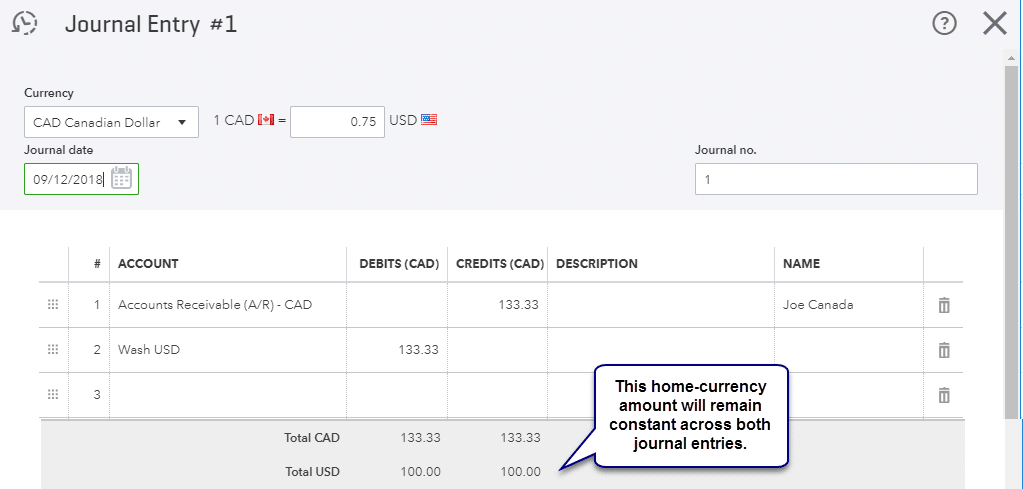

The user should create a journal entry for moving the receivable/payable from the original customer to the home-currency wash account:

- Currency – It has to be identical to the original customer on the deleted journal entry.

- Exchange rate – It should be exactly the same as on the deleted journal entry.

- Credit A/R or A/P – It should reflect the same amount as is on the deleted journal entry in original customer’s currency.

- Debit wash account – It should have the same amount as was in the deleted journal entry in the original customer’s currency.

Step 4:

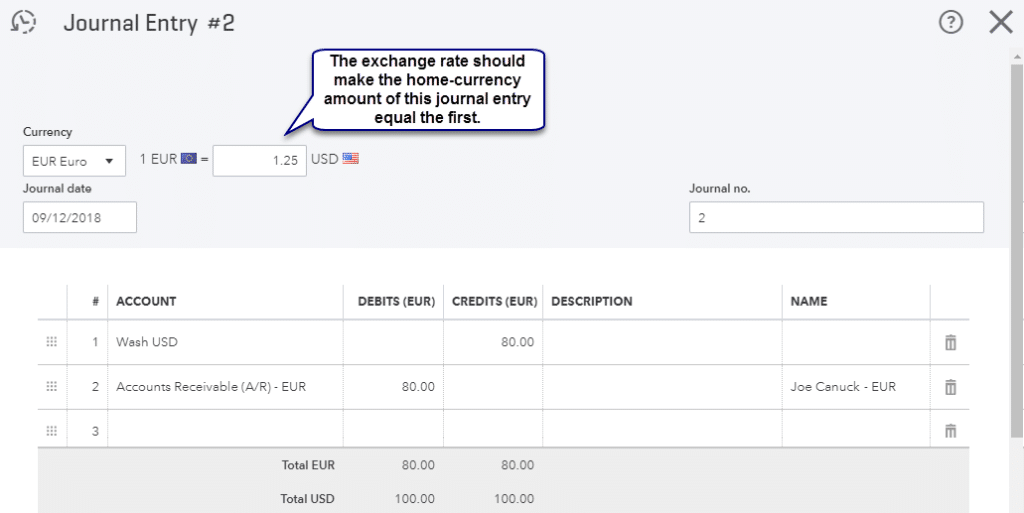

Proceed with the creation of a second journal entry in order to transfer the receivable or payable from the currency of the wash account to the currency of the target customer:

- Currency – The currencies of the original and the target customers should be the same.

- Exchange rate – It should be set in such a manner that the home currency value corresponding to this journal entry shows exact match with the home currency value pertaining to the journal entry created earlier in Step 2. This ensures that no remainder is left in the wash account. This generally equals the ratio of the home currency amount of the first journal entry and the target currency amount.

- In case the target currency is identical to the home currency, in that circumstance, no exchange rate is possible since the ratio is 1:1.

- Credit wash account – It should be the same as the target currency.

- Debit A/R or A/P – It should be same for the target currency amount. The user is required to assign the target-currency duplicate customer in this line item.

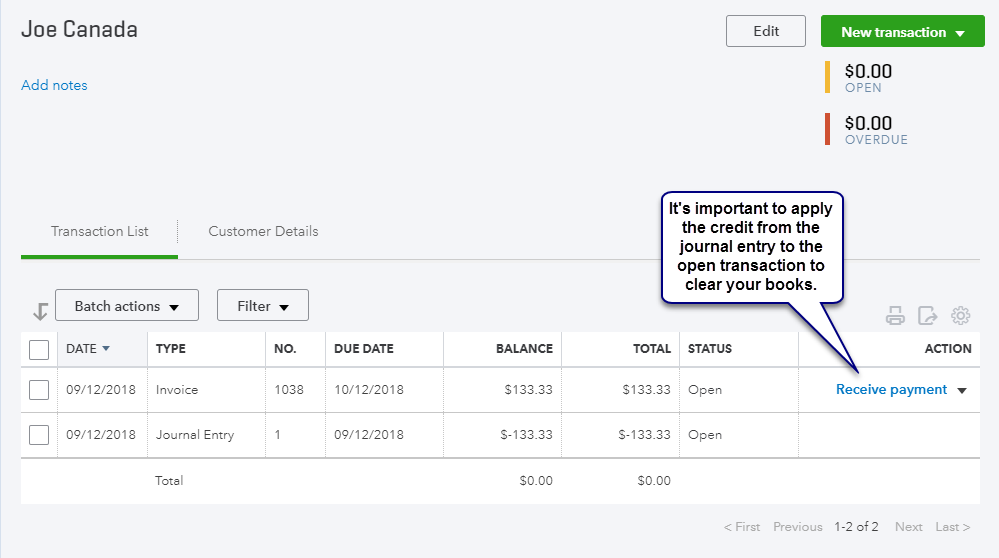

Step 5:

Follow up with the closure of the original open transaction with the original customer. For this, apply the credit from the first journal entry to it.

Step 6:

The receivable/payable should now be relocated to the target currency of the duplicate customer.

Winding up!

In this article we presented the different approaches to record Multi-Currency Journal entries without entering the Journal Entry error. This way, users should also be able to fix Journal entry error in QuickBooks. Feeling a need for technical guidance? Just give our QuickBooks desktop support professionals a call at 1-888-368-8874.

Interesting Reads