The world’s leading accounting software, QuickBooks, is crucial in bringing small and medium-sized business owners, entrepreneurs, and accountants closer to their respective organizations’ goals. Even though it’s a cutting-edge piece of software, it has some bugs. The “QuickBooks error 102” is one error you could encounter as a user.

You may get this error when a server has trouble transferring data between your bank’s website and QuickBooks. This could be due to website maintenance, a technical glitch on the bank’s end, or a problem with data transfer. In this article, we have discussed about the possible causes behind to this error and several ways to resolve QuickBooks banking error 102. Thus, keep reading to this article till the end.

What is QuickBooks Error Code 102 and Why It Happens?

QuickBooks error 102 is an error that occurs when there is a problem connecting to your bank’s website or if your bank’s servers are undergoing maintenance. This error prevents QuickBooks from downloading or uploading transactions, and it usually occurs when you are trying to connect to your bank account from within QuickBooks.

When you encounter this error, QuickBooks will display an error message on the screen, stating that the “Online banking connection has been interrupted“. This error can be frustrating because it can disrupt your accounting process, and you may not be able to see up-to-date financial data in your QuickBooks account. However, it is a temporary error that usually resolves itself after a while.

Reasons behind QuickBooks Banking Error 102 occurrence

This error typically occurs when there is a problem with your bank’s website or if the bank’s servers are undergoing maintenance. It can be caused by various factors, some of which include:

- Problems Connecting to the Internet

- Failure of Network Equipment

- Bank website undergoing maintenance

- Login failure to a financial institution

- Firewall or antivirus software blocking QuickBooks

- You are using an outdated version of QuickBooks

- Login credentials you entered in QuickBooks do not match the information provided to the bank.

Methods to Fix QuickBooks Banking Error 102

Some potential steps you can take to fix QuickBooks banking error 102 are provided below.

Method 1: See if there are any QuickBooks Online account updates you need to install

Account information in QuickBooks Online must be updated manually. If you click the link, you’ll get more details. At least three manual updates should be performed outside peak bank website hours. Not all accounts are automatically updated. Certain places will need you to update them manually. However, you’ll have to do it yourself if you are still waiting to see the current day’s information after an automatic update.

- Access “Banking” from the “Menu” in the lower left of the screen.

- To update only a subset of your accounts, click the “remove undesirable accounts” button.

- Pick “Update now” from the menu.

- When prompted, enter your “MFA (Multi-factor Authentication)” and click “Continue” to save the changes.

You only need to do one manual update every 90 days. Then, in the following 90 days, you will receive a new listing if it is referenced. By taking these steps, you may rest assured that your account will always reflect the most recent transactions, even if you need to disconnect it from your bank temporarily.

Method 2: Double-Check that all of your Account Information is Correct

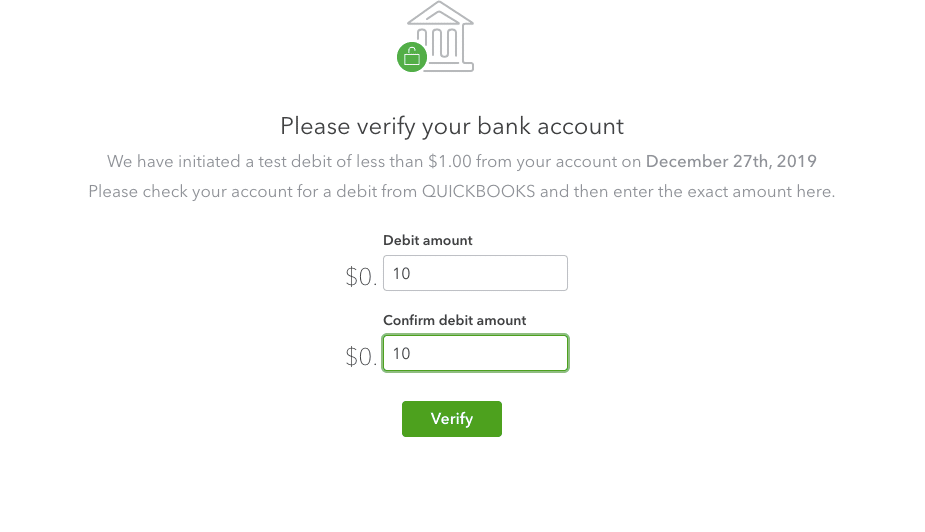

Attempt to access your online banking account by entering the URL provided by your financial institution. You can download and correct your QB Online transactions by adding your bank accounts, which are explained below. If you cannot establish a connection with your bank, you may get banking error 102. To link your bank account with QuickBooks Online, follow these steps:

- At first, select “Banking” from the “Menu” on the left.

- First-time users should choose “Search” to discover if their bank is already set up as a linked account.

- To add an existing bank account, select “Add Account” and then look up the name of your financial institution.

- Pick your financial institution from the options provided.

- To use your bank’s online services, you’ll need to provide your “User ID/Login ID” and password.

- To proceed, please press the “Continue” button.

- To establish a secure connection to your bank, please provide the additional information requested by the bank and click the “Connect securely” button.

- To link your bank or credit card account, click on the bank’s logo on the left and then choose it from the drop-down menu. If you don’t already have an account, you can create one by clicking the “Add + new” button.

- Once you’ve signed into your account for the first time, QuickBooks will automatically download your banking, credit card, and online transactions from the past 90 days. In addition, you can limit the days you can retrieve your transactions.

- Now hit a click on the “Link” button.

- You’ll be redirected to the bank’s homepage after the download is finished. Next, the downloads from your banking institution will be displayed on the “Review” page. In QuickBooks, you may verify, categorize, and approve the transaction.

- If your bank isn’t supported, you can’t get it connected, or the information you need is older than 90 days, you’ll need to get in touch with them or download the transactions from their website and then import them into QuickBooks.

Method 3: Determine Whether or Not Your Bank Account Is a New One

If you have recently opened your account or are using a bank or credit card for the first time, you may also get this banking issue. Some recently opened accounts cannot be accessed via internet banking. In this scenario, getting in touch with your financial institution or credit card company is best.

Find out whether your bank’s or credit card company’s website is down for maintenance. Use the Update symbol in the top right corner to access additional details. We suggest planning three manual upgrades for off-hours.

Method 4: Set it to Update Itself Automatically

If QuickBooks fails to update from a bank account, it will try to do so five additional times throughout the next five hours. We have no control over whether or not updates are downloaded automatically, but we may monitor when they occur by taking the following steps:

- Banking can be accessed from the left sidebar.

- Find the option to update in the upper right corner.

- The last updated time and date will be displayed in that column.

- Alternatively, you can perform a manual update.

- Banking can be accessed from the left sidebar.

- To only update the accounts you want, select “Clear Unwanted” accounts.

- Simply choose the now available update option.

- Once prompted, input your MFA info and proceed with the software upgrade by clicking the Continue button.

- For the next 90 days, you can count on your updates being complete if you perform a manual update.

Method 5: Verify your Account Details

Verify that your bank’s website lets you enter your login data successfully. If you cannot download the transaction in QuickBooks Online due to error code 102, you should investigate the cause of the error and then try again.

- Banking can be accessed from the left sidebar.

- If you still need to link your bank account, try searching for your bank’s name.

- Choose Add account, then look up the financial institution by name to see if it is already connected.

- Also, choose the financial institution that you wish to interact with.

- To proceed to the bank’s website, click “Continue” after entering your User ID / Login ID and password.

- If prompted, select “Connect” securely and continue with the additional security verification steps.

- Now choose the bank logo and account type from the drop-down menu.

- Open a bank or credit card account, but not both. If you’re not logged in, you can make a new one by selecting the “Add New” button.

- After that once QuickBooks is linked to your bank and credit card, it will automatically download 90 days worth of transactions.

- Once the download is complete, you’ll be taken back to the banking page, where you can click the “Review” option.

- The downloaded transaction can then be inspected and accepted or rejected.

Method 6: Create a New Account

Sometimes, a a new account will not work while trying to access services online. You should call your financial institution or credit card provider in that situation. Contact the support if you’re still having trouble after trying these solutions to the error code 102 in QuickBooks online.

Final Words

We have seen above the ways to troubleshoot QuickBooks banking error 102. Additionally, if your bank’s website is experiencing technical malfunctions, maintenance, or server issues, you may see this error due to these technical difficulties, communication between the bank’s website and QuickBooks is impeded.

If the error persists even after following the above given methods, you can get in touch with our QuickBooks online support team via dialing our helpline i.e., 1-888-368-8874. Our technical support team will help you to rectify the ongoing issue or any other accounting related issue within no time.

Related Articles: