Are you seeking to create a new QuickBooks company file from an existing one? Here is the complete guide that you can follow so as to create a new QuickBooks company file. This can be a time-saving technique as it can create a basic framework of the new company files which would comprise accounts, different types of lists, templates, and preferences. Users don’t need to start the company files from scratch but should simply copy and use accounts lists, templates, and preferences from an existing company file to start with.

The process requires the creation of a copy of an existing company file and then condensing the file to remove all the transactions. This will give a basic framework to make use of the new company file. Keep reading this segment to unleash the entire process to create a new QuickBooks company file from an existing one.

Essential Points to Remember

Before starting with the process of creating a new QuickBooks company file from an existing one, make sure to go through the below pointers one by one:

- Just in case you wish to create a new file just because you are experiencing QuickBooks desktop performance or data issues, then we suggest you fix the issues first.

- You should also note that QuickBooks might not be able to remove all of the transactions in case you have the payroll data for the current year.

- Another essential point can be if you use QuickBooks-assisted payroll, then we suggest you to consult some professional before starting with the steps

- If you are making use of QuickBooks payroll, direct deposit, e-file, or e-pay, then it is suggested to ensure that the subscription is only active for one company

When should I create a New QuickBooks company file from an Existing One?

The user should create a new Company file from an existing one in the following situations:

- Slow performance of QuickBooks and recurring freezing of QuickBooks especially when accessing the company file.

- Surpassing the List limits

- Corruption in the company file data

- Conversion of Inventory items to non-inventory items or vice versa

- When tools like QuickBooks File Doctor and Verify and Rebuild Tool fail to fix the company file issues.

- The company file changed from one business type to another.

Procedure to Create a New QuickBooks Company File in QuickBooks Desktop Enterprise, Enterprise Accountant, or Premier accountant

QuickBooks Enterprise or Accountant users have a composite feature which can help them create a new company file from existing one in no time. The process is presented in a schematic order below:

- Begin by heading to the File menu, and when reached there, opt for the “New Company from Existing Company File” tab.

- The next step is to tap on Browse and soon after, choose the Company file to be copied.

- Now, open the company file and then give a suitable name to this name.

- Assign a name to the copy of the company file.

- After that, click on the Create Company option.

You should also note that QuickBooks copies the preferences, sales tax items, memorized reports, and chart of accounts to the new company file. This won’t bring over bank or credit card accounts, ad would not copy sensitive information.

Walkthrough to Create a New Company File from an Existing one in QuickBooks Desktop

The procedure below should be adhered to for the easy creation of a new company file from an old one. Before proceeding any further, first make sure that you take a backup of the company file data. Once that is accomplished, follow the steps given below:

Step 1: Creating a duplicate copy of the existing company file

This first step involves the creation of a copy of an existing company file. The steps are:

- Run QuickBooks.

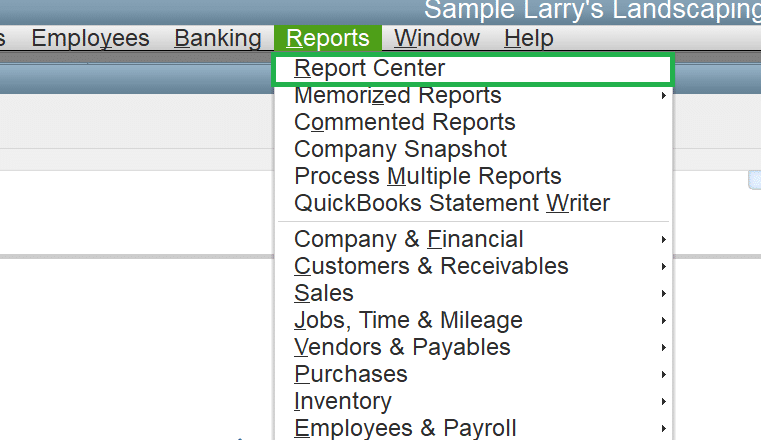

- Move to the Report menu.

- Opt for the report to keep a copy of:

- Account balance: Choose the company and financial, then the balance sheet detail.

- Customer balance: Pick customers and receivables and then select customer balance detail.

- For vendor balances: You need to opt for the vendors and payables, and then the vendor balance detail.

- Just in case you wish to customize the reports to better fit the needs.

- On the report window, it is suggested to select the print drop down

- From where, you can select print, if you want to keep a physical copy of the report.

- Choose the Save as PDF option in case you wish to have a digital copy.

Step 2: Export the lists from the old company file

You need to enter each of the lists manually. And can also export the accounts and lists from the old company file and carry them over to the new one.

Step 3: Create a new company file

- In this step, you need to open the QuickBooks Desktop.

- And further, choose to Create a new company in the No company open window.

- You will see two options:

- Either select Express start or start Setup, in case you want to start straight away. You will have to enter the business name, industry, and business type to create the company file. You can enter the information later on.

- Else, select the Detailed start tab to complete setup so all of the information is in from the start.

- You are then required to follow the prompts that appear on the screen so as to Finish setup. You should note that if you have an existing company file in QuickBooks, then a unique name should be assigned to another one.

Step 4: Import the lists and enter the beginning balances

In the new file, you can import the lists and enter the account’s initial balances. You are first required to import the accounts and lists. And also enter the beginning balances.

Step 5: Examine the Accounts

Condensing the company file should remove the transactions. To get this double-checked, just Run a Transaction List by Date report and check if the transactions got removed.

- First step is to make a move to “Reports menu”, and from there, tap on the “Reports Center”.

- The following step is to search for the “Account and Taxes” section.

- Upon locating that, proceed by opening a “Transaction List by Date report”.

- Change the date range for the report in such a way that it begins before the oldest transaction of the copied file.

- Check if all the transactions got removed.

- The file is now ready for incorporation of new data and is as good as new.

Step 6: Set up online banking, payroll, and other services

- Under this, you should set up bank accounts for bank feeds.

- Also, set up Intuit Data Protect so as to back up the new file.

- Further, connect the existing payments account.

- You are then required to set up advanced inventory for QuickBooks desktop enterprise.

- And track account balances by classes using class tracking.

Summing Up!

That was all you needed to know so as to create a new QuickBooks company file using an existing one. For any queries, comments, or concerns, call our QuickBooks desktop support team at +1-888-368-8874!

Other helpful topics: