Download and Install QuickBooks Tool Hub to Fix Common Errors

Learn to fix common problems and errors with the help of QuickBooks Tool Hub

Struggling with QuickBooks errors or performance problems? Intuit, the creators of QuickBooks accounting software, has the ultimate answer: QuickBooks Tool Hub. This recently introduced, multi-functional application is your go-to, one-stop solution, integrating a comprehensive collection of advanced tools into a single, powerful resource. QuickBooks Tool Hub is designed to tackle a wide array of common QuickBooks issues, providing essential functionalities that were previously scattered across various utilities. Within this invaluable asset, you’ll find powerful tools like QuickBooks File Doctor to diagnose and repair company file issues, the QuickBooks Refresher Tool to optimize performance, the Condense Data Tool for managing large company files, the PDF and Print Repair Tool to fix printing and PDF-related glitches, the Install Diagnostic Tool to resolve installation errors, and the Connection Diagnostic Tool to troubleshoot network and connectivity problems, among many others. Empower yourself to quickly diagnose and resolve common QuickBooks issues with this essential suite of tools. Download QuickBooks Tool Hub today and streamline your troubleshooting process.

What is the QuickBooks Tool Hub program?

This tool is a compilation of tools that are used by users so as to get rid of various minor and major QB-related bugs. You need not download and install multiple tools; simply download the QuickBooks Tool Hub program, and you are good to go. You will have to download the tool hub from the Intuit official website. This will fix the common errors for you, and all you need is to have Windows 10 (64-bit) on the PC. Steps, as you need to follow here, are

- In the first step, you need to close your QuickBooks.

- After that, download the recent version of QuickBooks Tool Hub and save it to your system.

- Moreover, access the .exe file of the tool hub that was downloaded.

- Moving ahead, you need to agree to all the terms and conditions by following the on-screen prompts.

- Now open the tool by double-clicking on the tools hub icon

How to Fix Common Problems and Errors Using QuickBooks Desktop Tool Hub?

Learn how to get the different QuickBooks desktop tools in order to resolve the common QuickBooks errors.

Step 1: Download and Install the QuickBooks Tool Hub Program

In order to download the QuickBooks Tool Hub, you can perform the below steps:

- Start off by downloading the tool from Intuit and saving the file to an accessible location.

- After that, launch the QuickBooksToolHub.exe file to start with the installation process.

- Moving ahead, click on the Next tab.

- And later you will be asked to accept the License and Agreement to Intuit’s license agreement. For which you should hit on Yes.

- In the next step, select the QuickBooks Tool Hub program, install the destination folder, and hit Next.

- Now tap on the Install tab to start the installation.

- Opt for the Finish tab and the tool hub will open up after this.

Step 2: Use QuickBooks Desktop Tools From the Tool Hub

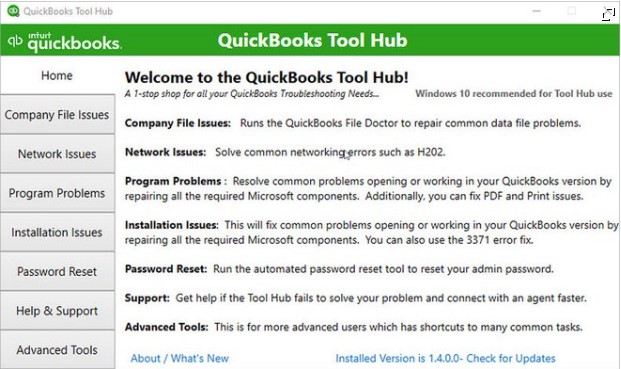

Now that you have downloaded the QuickBooks Tool Hub program, you will see the following components inside the Tool Hub:

Home

The home screen gives essential information that is associated with the QuickBooks Tool Hub. It also specifies the components that are to be used for specific problems.

Company File Issues

The next component that you will see is the company file issues tab that can be opted for fixing the company file-related issues. You just need to choose the second tab and run QuickBooks File Doctor by using the below steps:

- You would need to tap on the Run QuickBooks File Doctor green tab.

- And have patience till it opens.

- Choose the Browse tab and head for the company file that is to be repaired.

- Verify that the Check your file option is chosen.

- Afterward, log in to the file as an Admin user.

- And hit on the Continue tab.

Network Issues

In case you get any type of network issue, then go for the third component. You’ll have to go for this particular option to use the QuickBooks database server manager.

Program Problems

The next tab that would be seen is the program problems tab. This includes the Quick Fix My Program, QuickBooks Program Diagnostic Tool, and QuickBooks Print and PDF Repair Tools.

- Quick Fix My program feature will terminate all the background processes from QuickBooks and run a quick repair on the program. This process might take a few minutes but would resolve the error properly.

- QuickBooks program diagnostic tool can be used to repair various errors and work with every Microsoft component that is used by QuickBooks.

- The print and PDF repair tool will help you in fixing print- or email-related issues.

Installation Issues

If any errors pop up on your screen during the installation of the QuickBooks software, they can be resolved by choosing this tab. You will see QuickBooks install diagnostic tool, QuickBooks clean install tool, & 337a error fix tools therein.

Password Reset

Further, you will the password reset component, which can be opted for resetting the QuickBooks password

Help & Support

This is basically the last component that you can opt for in order to avail of QuickBooks support.

Advanced Tools

This one would be used when you face other issues that you are unable to fix with the above components.

Perks of QuickBooks Tool Hub

Following are the perks of the QuickBooks Tool Hub program:

- The major perk is that it is free, and there is no fee associated with its usage.

- Moreover, if you are facing network issues, then the tool hub can be the best option for you.

- The tool hub is a great tool even for company file errors.

- Also, it has a basic and simplistic interface, which is intuitive enough.

System Requirements for QuickBooks tool hub

In order to make the best use of the QuickBooks Tool Hub program, you will have to ensure that your system meets the requirements for the same. To ensure optimal performance, it’s recommended to have a higher-specification computer, especially if you are working with large company files. Additionally, it’s important to keep your operating system and other software up-to-date to ensure compatibility with Tool Hub.

| System Requirement | Version/Driver/Hardware/Software |

|---|---|

| Operating system: | Microsoft Windows 10, 8.1, 8, or 7 (64-bit) |

| Processor: | 2.4 GHz or higher |

| RAM: | 4 GB or higher |

| Hard drive: | 2.5 GB of available hard-disk space |

| Screen resolution: | 1280 x 1024 or higher with up-to-date video card driver |

| Internet connection: | High-speed internet connection recommended for download, installation, and use of the tool |

| Microsoft .NET Framework: | Version 4.7.2 or higher |

| Microsoft Visual C++ Redistributable: | Versions 2015 to 2019 |

Net Framework: It is very much essential for you to have a .Net Framework on the system for installing the tool hub program.

Microsoft Visual C++ redistributable package—Another system requirement is the Microsoft Visual C++ redistributable package.

List of Errors that can be Fixed With the QuickBooks Tools Hub program

In the practical sense, the tool hub software solves all major and minor errors. The following are the errors that you can try to resolve using this tool hub program:

Install issues or errors:

If QuickBooks Desktop has troubles with installation-related problems while installing QuickBooks Desktop, then you need to click on the Installation Issue tab and choose the given options one by one to rectify the issue. This will help you in fixing all the install-associated errors.

Login issues:

There can be situations when you miss out on the QuickBooks password; then, in that case, you would have to tap on the Password Reset tab and pay heed to the on-screen instructions. This will assist you in resetting the password successfully.

Company file errors:

In case of company file errors, you can opt for the Company File Issues tab. This will help you in opening the QuickBooks file doctor and repairing the company file. Moreover, you will have to perform the on-screen instructions

Connection and network troubles:

When you encounter connectivity issues on a specific network, then you can tap on the Network Issues tab and this will help you in fixing the network-related bugs.

Performance bugs:

The performance problems tab in the QuickBooks Tool Hub can be used when QuickBooks starts lagging and the user is unable to fix issues.

Other Related Errors

Other than the above-stated errors, there are a couple of other bugs as well, which include the following:

- PDF and printing errors

- H series errors (H202, H505, etc.)

- QuickBooks crashing errors

- Company file issues

- Networking errors

- -6000 series errors

- QuickBooks error 6123

- And a lot more

The Final Note..

This was all that you needed to know about the QuickBooks Tool Hub program. However, if you need any help, you can connect with our QuickBooks desktop support team via our dedicated helpline, i.e., 1-888-368-8874. Our team will provide your business with the right support that it needs to eliminate errors and QB-related glitches, ensure success, and save some serious money. We have the most relevant solutions to all your errors and other accounting software-related issues.

Related Articles: